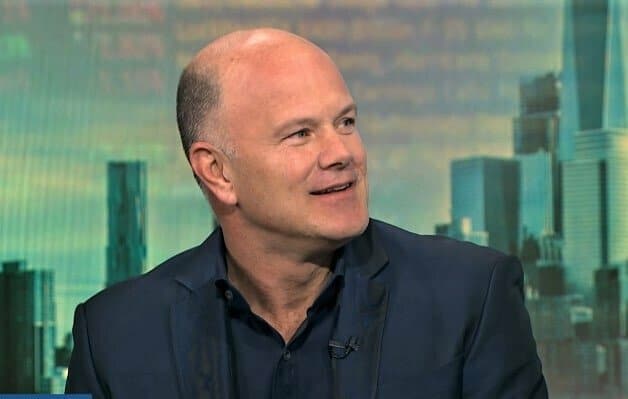

Billionaire Mike Novogratz Optimistic about Bitcoin and Precious Metals

Shift in Federal Reserve’s Monetary Policy

Billionaire investor and CEO of Galaxy Digital, Mike Novogratz, is expressing optimism for assets like Bitcoin, gold, and silver as the Federal Reserve undergoes a shift in its monetary policy. Novogratz believes that this transition from a hawkish stance to a more dovish one will unleash “animal spirits” in the financial markets.

Impact on Currencies and Economy

Novogratz points out that market participants are already anticipating a pivot by the Fed, causing the US dollar to weaken. In response, Novogratz remains bullish on the euro, Australian dollar, and Brazilian real while maintaining a short position on the Chinese yuan due to underlying structural issues within the Chinese economy.

Effect on Assets

With a short dollar position, Novogratz expects the US economy to slow down, inflation to cool off, and the Fed to initiate rate cuts. In such a scenario, he believes that assets such as gold, silver, and Bitcoin will perform well. Novogratz expresses positive sentiment towards gold and suggests that if the precious metal sustains a close above $2,000 for a few weeks, it could embark on a significant upward trajectory. He also notes that silver appears to be primed for a surge as it faces a squeeze in market conditions.

Factors Driving Bitcoin’s Potential Growth

According to Novogratz, several other factors could drive Bitcoin to new heights. These include the potential approval of spot Bitcoin exchange-traded funds (ETFs), a shortage of sellers in the market, and the upcoming halving cycle. He further suggests that the forthcoming election year in 2024 could introduce additional political uncertainty, serving as a tailwind for Bitcoin.

Demand for Alternative Stores of Value

As the United States, Europe, and Japan continue to grapple with fiscal challenges, investors are seeking alternative stores of value. This demand initially fueled the interest in Bitcoin. Additionally, the optimism around the launch of a spot Bitcoin ETF has driven the recent rally in crypto markets.

Analysts at financial services firm Cantor Fitzgerald believe that the long-awaited spot BTC ETF is inching closer to reality. They are confident in the approval of applications from asset managers seeking to launch a spot ETF for Bitcoin. Cantor Fitzgerald believes that the proposed market surveillance procedures by new applicants could address concerns about potential manipulation on offshore spot platforms and sway the SEC towards approval.

Josh Siegler and Will Carlson, analysts at Cantor Fitzgerald, emphasize the importance of establishing a “comprehensive surveillance-sharing agreement with a regulated market of significant size” to appease regulators.