Asset management firm Vanguard has recently announced that it will not be joining its competitors in pursuing a spot Bitcoin exchange-traded fund (ETF). This decision sets Vanguard apart from rivals like BlackRock and Fidelity, who have pending applications for Bitcoin ETFs. In a recent interview with CNBC, Vanguard CEO Tim Buckley made it clear that the firm has no plans to follow suit.

“We won’t be pursuing a bitcoin ETF. It’s just like we don’t use gold as an asset class for our clients,”

– Tim Buckley, CEO of Vanguard

Vanguard’s Perspective on Cryptocurrencies

A Vanguard spokesperson further elaborated on the firm’s perspective, expressing skepticism towards cryptocurrencies. The spokesperson pointed out that unlike stocks and bonds, most cryptocurrencies lack intrinsic economic value and generate no cash flows, such as interest payments or dividends. Additionally, cryptocurrencies have proven to be highly volatile, which goes against Vanguard’s goal of generating positive real returns to investors over time.

It is worth noting that the regulatory landscape surrounding cryptocurrencies has been a point of contention, with the SEC previously rejecting several Bitcoin ETF applications. However, there is hope that regulatory obstacles may soon be cleared for the approval of a spot Bitcoin ETF, as Grayscale Investments recently won a court case against the SEC.

Enthusiasm for a Bitcoin ETF Grows

Despite Vanguard’s decision, enthusiasm for a potential spot Bitcoin ETF continues to grow on Wall Street. Prominent cryptocurrency advocate Mike Novogratz believes that blocking an ETF would make no sense. Market trends also reflect this sentiment, as inflows into digital asset funds reached their highest weekly level since July 2022.

“Blocking an ETF makes no sense.”

– Mike Novogratz, cryptocurrency advocate

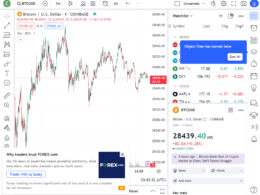

According to a CoinShares report, digital asset investment inflows reached $326 million for the week, with Bitcoin accounting for 90% of the inflows. The anticipation of a spot ETF approval has led to a surge in Bitcoin’s price in recent weeks. The cryptocurrency rallied towards $35,000 earlier this month, driven by market speculation surrounding the potential approval of a spot ETF.

This surge in price has not only caught the attention of investors but has also sparked a renewed interest in crypto trading. Daily exchange volumes have experienced a significant increase, with the seven-day moving average for spot exchange volumes across reputable platforms breaching an impressive $24 billion on October 26. This level has not been seen since the end of March.