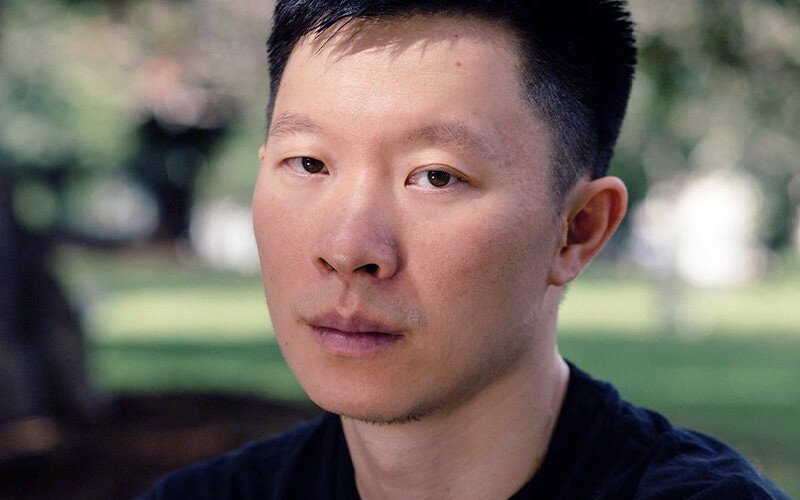

Su Zhu’s Perspective on Prison Life

Su Zhu, the co-founder of the now-defunct hedge fund Three Arrows Capital (3AC), recently reflected on his time spent in prison, presenting an unexpected viewpoint. In a video podcast, Zhu intriguingly described his prison stint as an “enjoyable experience overall,” surprising many listeners.

During the podcast, Zhu went on to express gratitude for his time behind bars, mentioning that it provided him with the “best sleep” he had ever experienced. He even went as far as suggesting that everyone should have a chance to encounter prison life at least once, believing it to be enlightening.

“You can read all the books you want,” Zhu shared. “You can do all the pushups you want.”

Zhu delved into his daily routines in prison, emphasizing the simplicity of entertainment available and drawing parallels to practices from ancient times. He highlighted the structured lifestyle within the facility, where he had access to abundant reading material, opportunities for exercising, and a regulated diet.

Additionally, Zhu was particularly impressed by the quality of sleep in the prison environment. He marveled at the strict lights-out policy from 9:30 pm to 5:30 am, which facilitated undisturbed rest and led him to declare it as the most restful sleep of his life.

“And then the sleep is amazing… because they’ll turn the light off at 9:30 pm and the light comes back on at 5:30,” noted Zhu. “I actually had the best sleep of my life in prison.”

He further revealed an unexpected connection with his past through the use of mats instead of conventional beds, indicating a profound psychological effect of his incarceration.

Legal Issues and Controversy

In October of the previous year, Zhu’s situation took a legal turn when he was apprehended in Singapore while attempting to flee the country. The fund’s liquidator, Teneo, disclosed that Zhu, along with his partner Kyle Davies, was detained at Changi Airport following a committal order from the Singapore Courts.

Both Zhu and Davies received a committal order for contempt of court, resulting in a four-month prison sentence. Subsequently, they were served subpoenas to cooperate with Teneo’s investigative efforts to understand the reasons behind the fund’s collapse.

Despite their active social media presence post-collapse, Zhu and Davies remain evasive from the authorities and the fund’s liquidators. Moreover, the Monetary Authority of Singapore imposed a nine-year ban on both individuals, preventing them from engaging in regulated investment activities.