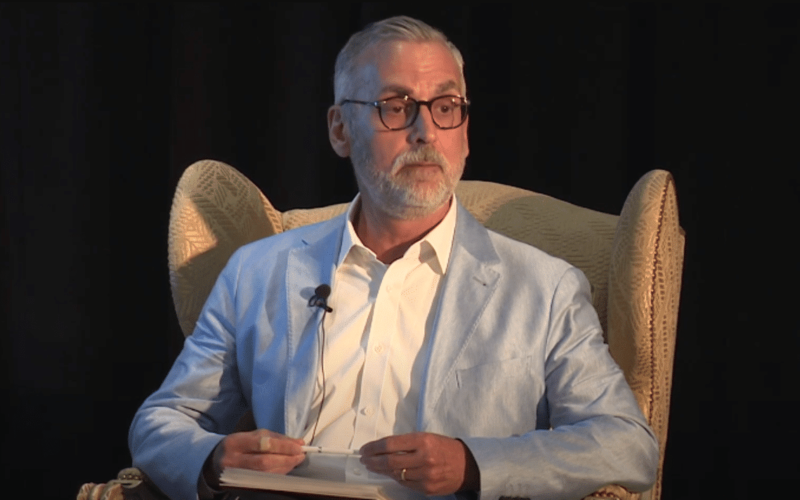

Ripple’s Chief Legal Officer, Stuart Alderoty, has raised concerns about the Securities and Exchange Commission’s (SEC) recent actions, referring to their behavior as “shady.” In a social media post on X (formerly Twitter), Alderoty pointed out the loopholes in Gary Gensler’s speech at the 2023 Securities Enforcement Forum, suggesting that the Commission is losing international relevance following their defeats in high-profile cases.

“The Commission is losing credibility by prejudging companies without proper investigations,” stated Alderoty.

Alderoty emphasized the need for fact-checking after reviewing a video in which Gensler claimed that the SEC does not prejudge companies. Many individuals in the crypto community have criticized this statement, arguing that Ripple and other companies were indeed prejudged before any thorough investigation took place.

John Deaton, a pro-XRP lawyer, also joined in the criticism of the SEC’s approach towards the industry. Deaton even humorously suggested that Colonel Jessep from the movie A Few Good Men was more likable than the SEC. Gensler’s video continued to generate reactions from the community, shedding further light on the flaws of his enforcement strategy.

Industry Figures Disagree with the SEC

Erik Voorhees, the CEO of ShapeShift, added his voice to the chorus of critics, refuting the SEC’s claims of not prosecuting honest businesses. He revealed that his honest company had been targeted twice by the SEC. Others have accused the Commission of undermining investor confidence with a harsh policy that has forced many firms out of the country and brought negative consequences to the sector.

“The SEC’s policies serve to suppress retail traders’ grievances and protect the status quo that benefits the owners of the SEC,” argued a user on X.

Gensler’s Speech at the Securities Enforcement Forum

In a recent speech at the Securities Enforcement Forum, Gary Gensler addressed the SEC’s achievements in promoting investor safety. However, controversy arose when Gensler quoted Joseph Kennedy, stating that they are not prosecutors of honest business but rather “partners of honest business and prosecutors of dishonesty.”

Gensler highlighted their successful enforcement actions in recovering $5 billion in judgment orders and distributing $930 million to harmed investors. He acknowledged the need for increased market scrutiny and regulations to combat fraud, scams, bankruptcies, and money laundering prevalent in the crypto market.

“While some entities in this space claim to operate beyond existing regulations, we must ensure thorough oversight,” Gensler emphasized.