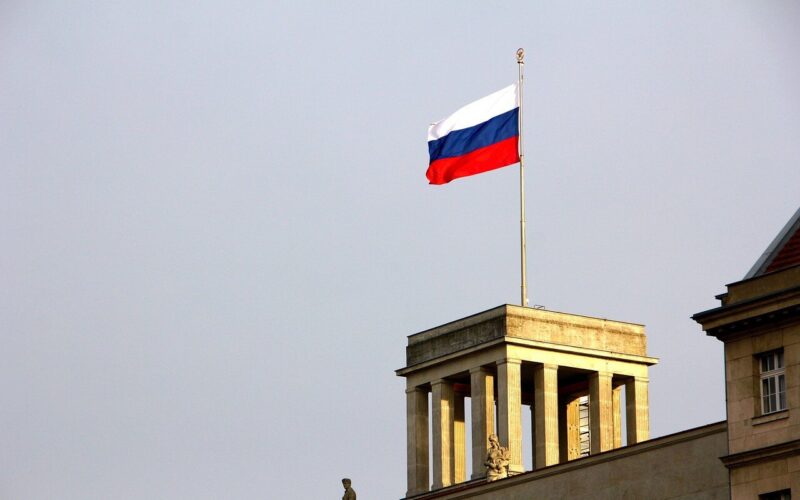

The Russian Ministry of Finance has put forward a groundbreaking proposal to export cryptocurrencies as a product of mining activities. This move aims to elevate digital currencies to the same level as traditional exports like natural gas, potentially revolutionizing the digital currency industry.

Equalizing Cryptocurrencies with Traditional Exports

Ivan Chebeskov, the Deputy Minister of Finance, unveiled the details of this innovative initiative during a round table discussion titled “Cryptocurrency and the Future of Digital Finance.” He explained that the regulations for exporting cryptocurrencies would closely resemble those governing gas exports. This would enable miners to sell their digital assets as exportable products.

“The proposed regulations for cryptocurrency exports would closely resemble those governing gas exports, enabling miners to sell their digital assets as exportable products.” – Ivan Chebeskov

In November 2022, a bill was submitted to the State Duma to legalize Bitcoin (BTC) mining and establish mechanisms for the sale of mined currencies. This recent proposal expands on that bill and includes provisions to ban cryptocurrency advertising. Additionally, it requires the sale of cryptocurrencies to be conducted through foreign platforms, excluding the use of Russian information infrastructure.

“Both the Ministry of Finance and the Bank of Russia support recognizing cryptocurrency mining as an industry and endorse the use of cryptocurrencies for settlements in foreign economic activities within an experimental framework.” – Ivan Chebeskov

The Ministry of Finance and the Bank of Russia are in favor of recognizing cryptocurrency mining as an industry. They also endorse the use of cryptocurrencies for settlements in foreign economic activities but only within an experimental framework.

New Rules for Cryptocurrency Miners

According to the proposed bill, cryptocurrency miners can acquire digital currencies through foreign systems or a dedicated platform established for experimentation. Either way, miners must report these transactions to the Federal Tax Service.

“The sale of mined cryptocurrencies should be limited to non-residents and conducted exclusively through foreign infrastructure.” – Central Bank

The Central Bank advises that the sale of mined cryptocurrencies be limited to non-residents and conducted exclusively through foreign infrastructure. Anatoly Aksakov, the head of the State Duma Committee on the Financial Market, indicated that the bill regulating cryptocurrency mining could potentially come into effect in 2024.

“The bill regulating cryptocurrency mining could potentially come into effect in 2024.” – Anatoly Aksakov

This document is currently undergoing further refinement following its initial reading in the State Duma.

The Digital Ruble and International Settlements

Earlier this year, Russian President Vladimir Putin signed a bill introducing a digital version of the country’s national currency, the digital ruble. The Bank of Russia, the country’s central bank, was granted legal authority to act as the platform operator for the digital ruble.

“One of the reasons behind Russia’s push into the digital ruble is to eliminate the need for the SWIFT payment system.” – Unknown

The digital ruble will function as a new form of payment alongside cash and non-cash rubles. One of the reasons behind Russia’s venture into the digital ruble is to reduce reliance on the SWIFT payment system, which has faced bans from the country.

The digital ruble could help facilitate international settlements for Russia, independent of a payment system controlled by the West.