Russian lawmakers are urging the country’s Central Bank to reconsider its retail model digital ruble and instead adopt a wholesale alternative. Three State Duma committees have jointly responded to the Central Bank’s monetary policy report for 2024-2026, expressing their support for a wholesale digital ruble.

Benefits for Businesses and Financial Firms

Lawmakers believe that a wholesale digital ruble could greatly benefit businesses and financial firms within the country, particularly in terms of interbank payments. This type of coin would enable smoother and more efficient transactions among these entities.

The Central Bank initially considered a wholesale model but later decided to give preference to a retail model. However, the lawmakers are now urging the bank to reconsider its decision.

Advantages for Russia’s Economic Plans

The lawmakers argue that switching to a wholesale digital ruble would be a timely move for the nation and its economic plans. They believe that this shift would provide Russia with greater flexibility and adaptability, allowing it to stay ahead of international rivals.

“Launching a wholesale CBDC would help Russia avoid missing out on flexibility and adaptability boosts,” the lawmakers stated in their joint response.

Furthermore, the MPs believe that a wholesale digital ruble could help Russia combat Western-led sanctions by reducing its dependence on Western payment infrastructure. They suggest that this cross-border payment innovation would facilitate trade between BRICS nations and other Russian allies.

Russian Central Bank’s Plan and Pilot

The Central Bank aims to expand its real-world pilots for the retail model digital ruble next year, with a nationwide rollout expected by early 2025. The bank also has ambitions for the CBDC to gain international recognition.

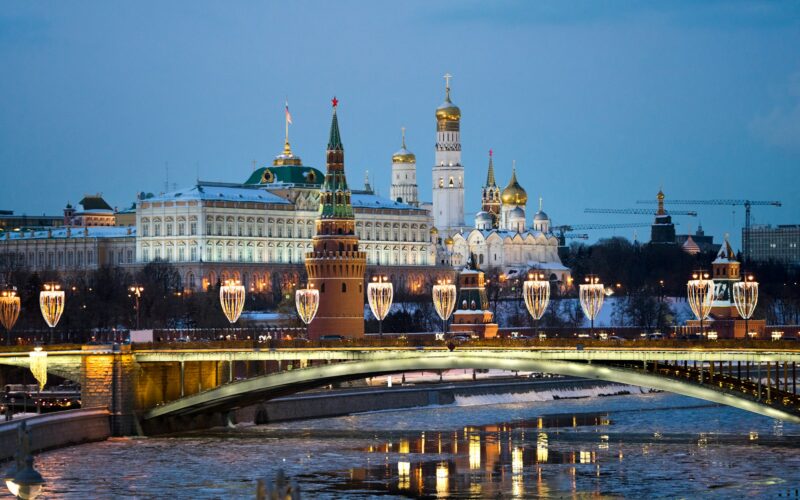

Meanwhile, some central banks in other regions are exploring the possibility of launching two-tier or parallel CBDC projects. However, the Russian Central Bank has reiterated its focus on providing CBDC solutions for unbanked citizens. Additionally, the retail digital ruble is seen as an alternative to cash for payments in remote regions of Russia. The pilot project is currently operational in 11 cities, including Moscow and Yekaterinburg, the capital.