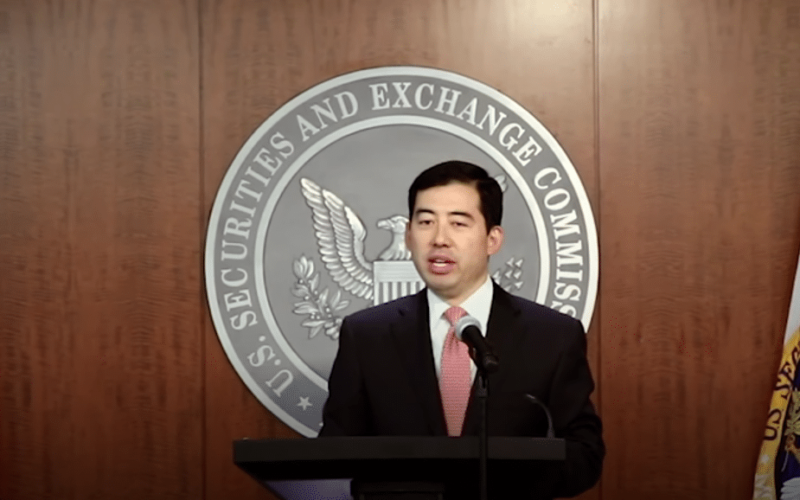

The US Securities and Exchange Commission (SEC) has been engaging in enforcement actions in the crypto space over the past three years. However, according to SEC commissioner Mark Uyeda, this approach is limiting the clarity needed in the industry. Uyeda expressed his opinions during the Friestad Memorial Lecture in London. He believes that the SEC should have established clear guidelines for acceptable and unacceptable behavior in the cryptocurrency industry to provide investors with the necessary clarity.

Instead of setting clear guidelines, the SEC, led by former blockchain professor Gary Gensler, has focused on enforcement actions. Uyeda sees this as a deviation from the expected norm of operation. He states that the agency has intentionally avoided proposing rules for the crypto space, despite issuing a slew of directives in the past two years. This approach shows that the SEC is not interested in public input regarding regulations.

The Securities Classification Debate

The Gensler-led SEC has categorized all cryptocurrencies (except Bitcoin and Ethereum) as securities. The agency listed 67 top crypto brands as asset securities, including Solana, Binance Coin (BNB), Cardano, Matic, Filecoin, and others. However, Uyeda disagrees with this classification, as he believes that the federal securities law only applies if an asset is deemed a security. The lack of clarity from the SEC has made it difficult for market participants and the courts to properly analyze the issue.

The SEC has been relying on the famous Howey Test to crack down on crypto firms it deems as defaulters. This test considers an investment contract as a transaction or scheme where a person invests money in a common enterprise with the expectation of making a profit from the efforts of the issuing party. Exchanges like Binance and Coinbase have already faced regulatory scrutiny. They have called on the SEC to provide clear expectations and roadmaps to ensure compliance.

The Impact on Innovation and Market Participants

The US Chamber of Digital Commerce has criticized the SEC’s regulation-by-enforcement approach, stating that it stifles innovation and forces market participants to relocate offshore due to the uncertain regulatory climate. This approach hampers the growth and development of the crypto industry.

“The SEC’s shortsighted enforcement actions have hindered the much-needed clarity in the nascent cryptocurrency industry.” – Mark Uyeda, SEC Commissioner

It is evident that there is a pressing need for the SEC to establish clear guidelines to regulate the crypto industry. This will provide investors with the necessary clarity and promote innovation within the market. By shifting from an enforcement approach to a more collaborative and proactive approach, the SEC can better support the growth of this emerging industry.