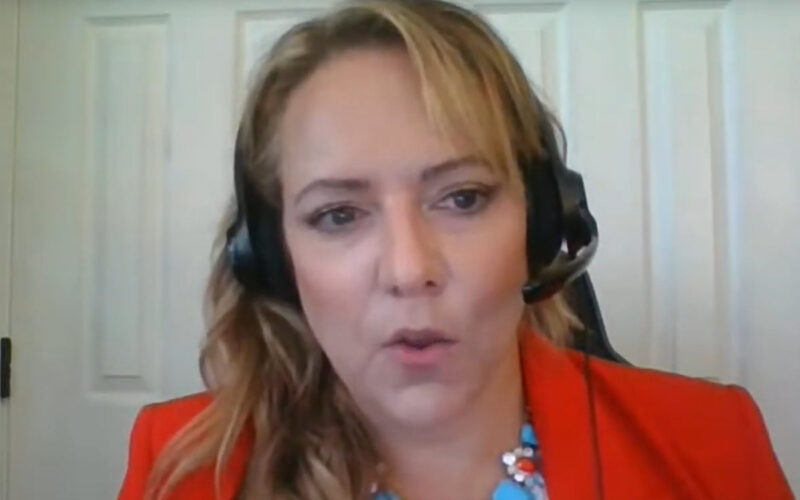

The world of cryptocurrency investing is quickly gaining traction in mainstream financial consciousness, as noted by pro-crypto Commodity Futures Trading Commission (CFTC) Commissioner Summer Mersinger. Speaking on CoinDeskTV, Mersinger emphasized that crypto trading is no longer a passing trend. She highlighted that government regulators, who initially perceived cryptocurrencies as a temporary phenomenon, have now witnessed the industry’s resilience and its integration with traditional finance.

Mersinger stated, “This gradual interaction between legacy financial institutions and the blockchain-driven economy proves the longevity of digital assets. This growing acceptance will attract even more mainstream investors seeking exposure to cryptocurrencies.“

The Rise of Bitcoin

The leading cryptocurrency, Bitcoin, has recently made headlines with its significant rally, primarily fueled by reports of a potential spot Bitcoin exchange-traded fund (ETF). In the past 24 hours, Bitcoin has surged over 12%, surpassing $35,000 and exhibiting bullish momentum. This rally was triggered by news of BlackRock’s iShares Bitcoin Trust being included in the list compiled by the Depository Trust and Clearing Corporation (DTCC), responsible for post-trade clearances, settlement, custody, and information services.

“The opportunity for a spot Bitcoin ETF is greater now than ever before,” stated Bloomberg’s senior ETF expert Eric Balchunas, highlighting BlackRock’s position as a frontrunner in securing regulatory approval.

Mersinger acknowledged that Bitcoin-based ETFs are already available in the market, reinforcing the growing interest in cryptocurrencies within the institutional landscape. She is not the only one who recognizes this trend.

The Institutional Interest in Crypto

During a special appearance on CNBC’s StreetSigns, Ernst & Young (EY) executive Paul Brody emphasized the pent-up demand for cryptocurrencies among institutional investors. Brody noted that the US Securities and Exchange Commission (SEC)’s reluctance to approve a Bitcoin ETF has created a backlog of potential investors waiting for regulatory permission to offer their services. He highlighted that asset management giants such as BlackRock and VanEck control around $200 trillion in assets under management (AUM), and their interest in cryptocurrency is substantial.

“Bitcoin, as the first decentralized currency, is seen by many investors as an asset rather than a payment tool,” explained Brody. He contrasted Bitcoin’s perception with Ethereum’s ETH token, which is predominantly viewed as a computing tool for facilitating permissionless value transfer.