The decentralized derivatives exchange SynFutures has successfully closed its Series B funding round, raising an impressive $22 million. Leading the investment round was Pantera Capital, a prominent player in the crypto investment space. Other participants in the funding round include SIG DT Investments, a subsidiary of the Susquehanna International Group (SIG DTI), and HashKey Capital.

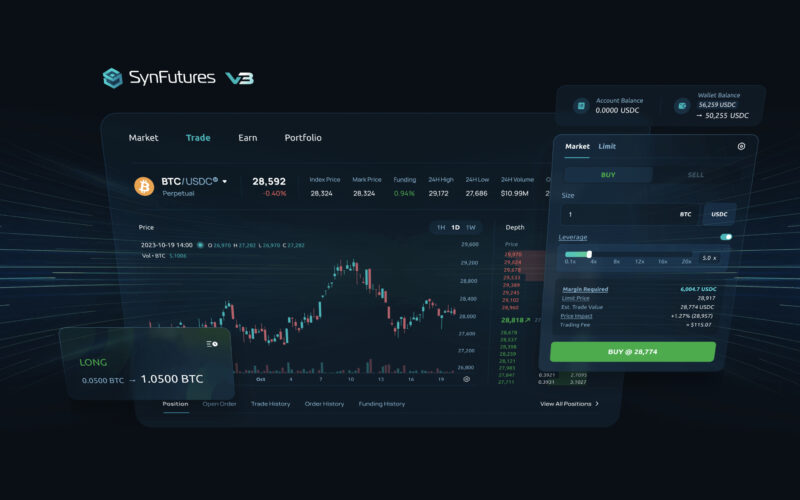

This significant investment comes as SynFutures introduces version 3 of its trading platform. The updated platform is currently available on testnet, with the official release on the mainnet scheduled for the fourth quarter of this year. According to a post on X, SynFutures’ team mentioned that users can now create test tokens, engage in trading activities, and explore the platform.

Innovative Features of Version 3

One of the key enhancements in SynFutures version 3 is the introduction of the Oyster automated market maker (AMM), which is fully deployed on-chain. This innovative AMM combines features found in both traditional orderbook and AMM models used by exchanges. By doing so, it improves liquidity and capital efficiency within the decentralized finance (DeFi) space.

The SynFutures protocol is built on the Polygon blockchain, providing a foundation for the permissionless listing of a wide range of trading pairs. These pairs include major cryptocurrencies, stablecoins, and non-fungible tokens (NFTs). Furthermore, the platform ensures two-sided liquidity, allowing users to provide liquidity using a single token of a trading pair.

Investors’ Perspectives

“We are excited about this investment as SynFutures introduces their updated decentralized trading platform,” stated Pantera Capital in a comment posted on X.

SynFutures CEO and co-founder, Rachel Lim, expressed her belief in the potential of DeFi to drive mainstream adoption in the crypto industry. In an interview with crypto news outlet Decrypt, she emphasized that the success of DeFi relies on its ability to strengthen and revitalize its derivatives ecosystem. Lim further stated that SynFutures V3 is designed to ensure that DeFi remains competitive with centralized finance (CeFi) and traditional finance (TradFi), positioning the platform for wider adoption by both mainstream users and institutions.